DeFi Enclave's Chronicles #5

Big Portfolio Update, Panoptic, LINK, Cake Wars, Silo, MVD vs MVX, Mozaic, A pack of great articles and much more.

In this episode:

Voyager's Observations - personal reflections and insights on DeFi and Beyond

Voyager's Vault - Detailed Report on My Investment Moves

DeFi Survivor's Bookshelf - Handpicked must-read threads and articles

DeFi Projects Radar - detailed survey of projects news and developments

Alpha Whispers - unexplored DeFi territory, proceed at your own risk

Voyager's Observations

CAKE Wars

I decided to skip CAKE Wars and other SubDAOs from Magpie except for Penpie.

Personally, I don't like such fragmentation, especially in locked tokens. I don't really believe in Pancake. Yes, they took over the BNB chain, but then they spent quite a lot of time and money on expansions in other chains and achieved absolutely nothing serious in terms of competition there.

This is what happens when you're a monopolist, you relax and instead of developing your main product, you start producing mediocre mobile games with the goal of quick earnings, while your competitors grow and regain the market from you.

Silo’s vaults on Beefy

Silo Labs has brought its vaults to Beefy, and it seems like it was Silo's initiative. This could potentially bring 200M or more in the form of vaults to Beefy.

Beefy is an example of a project that grows stronger after setbacks, which it had quite a few of.

Recently, they had a nasty incident with their main bridge - Multichain. After that, they migrated their token to Layer Zero and created a diversified system of different bridges with smart algorithms. I wouldn't be surprised if they add some AI to it.

Overall, I'm happy for the project and am now building up a position in their token. Yes, it's a straightforward, somewhat boring project where you won't see huge token multipliers, but you can sleep peacefully knowing that it's backed by serious professionals and a business model that earns in almost any market condition.

By the way, if they continued to develop during the bear market with all these problems, imagine what they can do in a bull market with increased cash flow for development.

Panoptic and Options sector

I received a whitelist in the Panoptic project. I've been following the project for a long time and never managed to test their product. This is another option project. I will report if I see potential in it, so far nothing special, just simple ready-made strategies, it will be interesting to see how they cope with the main problem in the options sector in DeFi - the lack of sufficient liquidity.

In general, I used to professionally deal with options in TradFi until I completely switched to the crypto industry, so option projects in DeFi have always been interesting to me. It's just that I haven't been able to find anything worthy so far. The sector is promising but so far no one has been able to achieve anything serious in it.

Dopex, Premia, Hegic - so-called leaders in this sector either offer ready-made strategies, which lack any flexibility, or provide you only a couple of strikes for trading, or create something wildly complex both visually and technically. There's no talk of mass adoption yet, as even people well acquainted with options are spending a lot of time trying to understand how the protocol works.

Dopex is a complete red flag, they were the leader a year ago and could have taken the entire options market (however modest it might have been), but they managed to lose their leadership, and recently they also created a circus with rDPX, where people lost their money. Sometimes you just have to admit that your product doesn't work and not risk the money of investors and users, but do something else.

Voyager's Vault

November 2023

Portfolio Objective: Boost the portfolio's value long-term and generate a steady income.

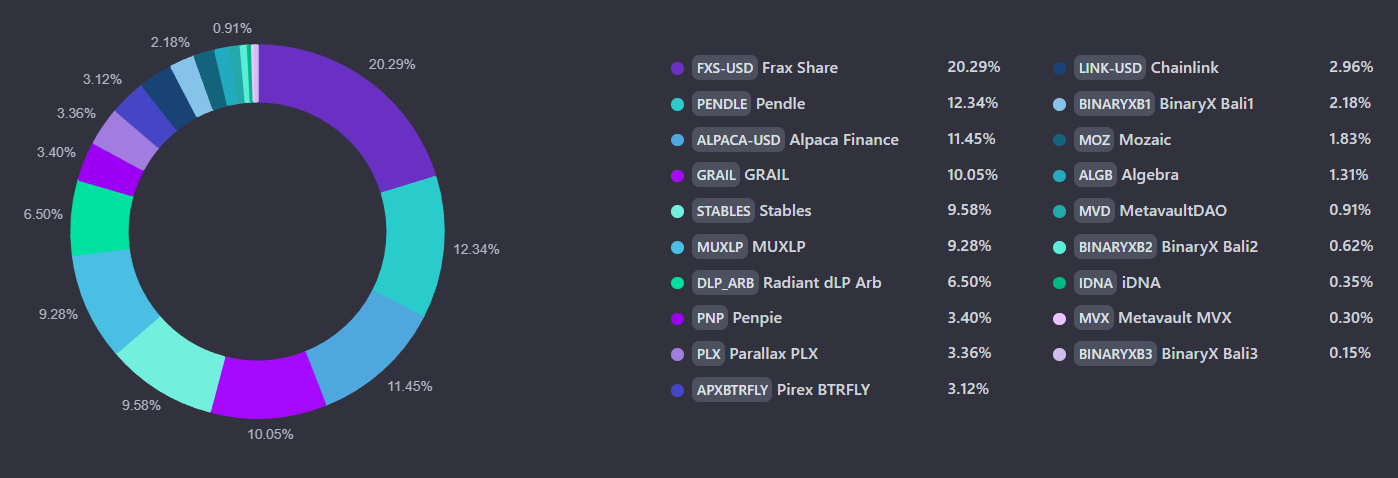

Portfolio Snapshot as of December 1st

New positions

MVD

MUXLP

LINK

Sold tokens

GNS

GLP

Increased positions

GRAIL

ALGB

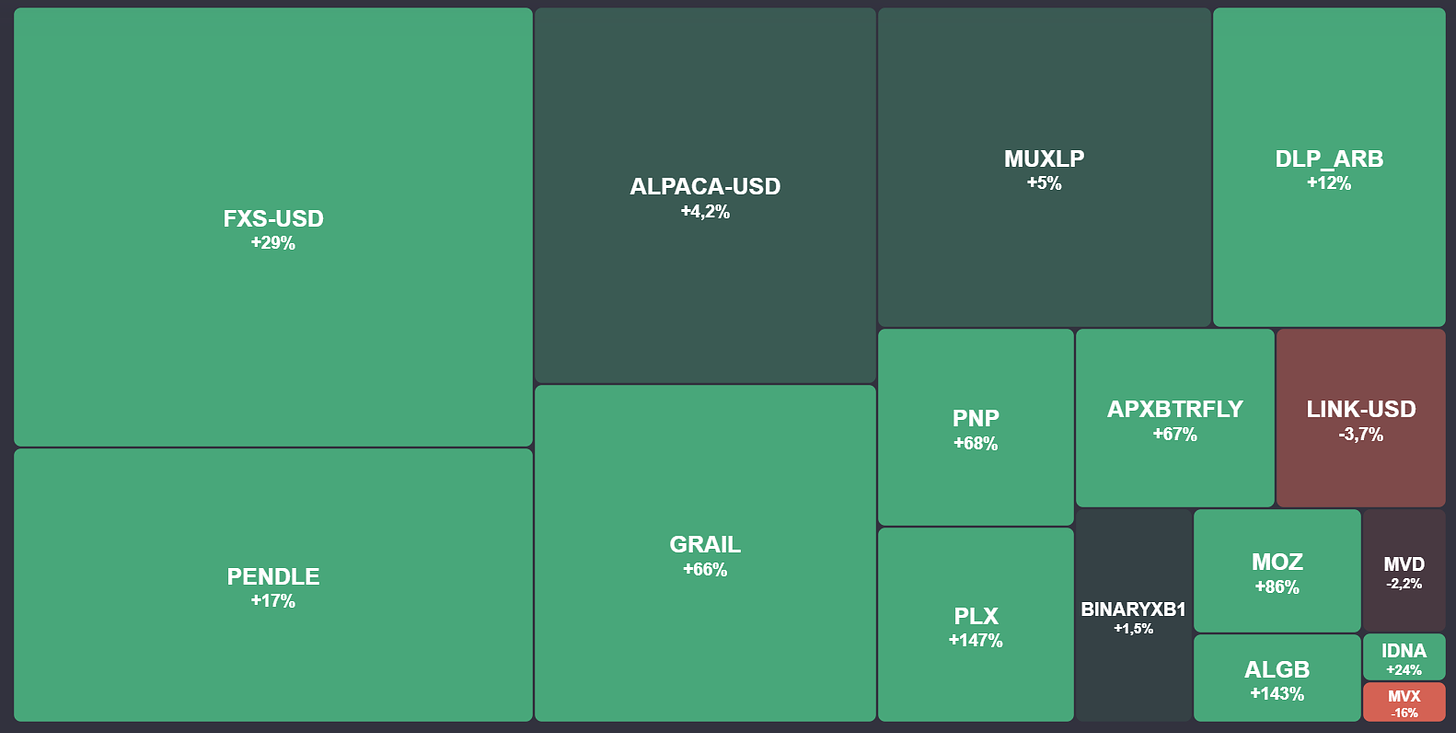

Heat Map for November

In November, passive income from farming/staking accounted for 2.8% of the total capital, which is approximately equivalent to an annual return of 33.75%.

Total capital growth in November is +22%.

My thoughts on the positions

LINK - I sold the remainder of my Pyth airdrop and bought Chainlink with this money. The thing is that one of my old wallets somehow got Early Access to Chainlink staking 0.2, which will open soon, and I decided to take advantage of the situation and try to stake in time.

Lately, I've been drawn to infrastructure projects. Celestia, Chainlink, Pyth, Akash, Render are constantly in the news. I'm even thinking about putting together a small portfolio of such projects. Obviously, these projects will play an important role in the development of the entire crypto industry. You just have to choose a token with good utility and tokenomics. However, I currently don't have much time for in-depth research on these projects.

I'm starting to have concerns about the micro cap portion of my portfolio, which ideally should not exceed 20% of the entire portfolio. This segment is growing too aggressively. While I am not a fan of selling assets that are experiencing growth, it may be necessary for the purpose of rebalancing.

So far:

PNP is almost twice as much as it should be

PLX - 6 times more

MOZ is twice as much

PENDLE - I started selling what is farmed on Penpie. The position is too large and I will transfer the passive income to other tokens.

ALPACA - in a week there will be an opportunity to finally unlock the tokens and then I will sell them. This was my first serious investment but the project has only been disappointing for almost the last couple of years.

GRAIL - I'm trying to buy more while it hasn't skyrocketed, the token is very undervalued.

PLX - I sell as soon as I receive tokens from vesting.

BTRFLY - need to buy more but the crazy cost of gas is off-putting, so here if you buy, then a lot and with one transaction but so far there is not so much cash on hand. The token is very undervalued even after +100% in a month.

Radiant DLP - all the earnings I get from Radiant, I reinvest back into DLP.

BIFI - I am gradually building up a position, but so far it is very small

I've moved stablecoins from Radiant to Silo & Digit (about which you will soon be able to read an article).

Currently, I don't have any new tokens in mind for purchasing. The portfolio has been established, and the only task remaining is to adjust the proportions of the tokens within the portfolio.

MVD vs MVX

I received a private message asking:

"I'm wondering what made you choose to buy MVD instead of MVX?

I've skimmed through their docs and I really like the product/approach, but it seems like MVD doesn't have a max supply and will continue getting diluted meanwhile MVX gets 50% of the revenue as well, but is a hard capped 4m max supply and is deflationary at the same time."

Great question. Let's delve into it.

If you've just started staking MVX, you'll have your Staked Multiplier Points at zero, which means you won't get a yield boost. For MVD, however, this boost is almost always at its maximum.

Revenue and airdrops from partner projects. I understand that with the launch of new products, the DAO could receive tokens from new projects. Soon, for instance, DAO should be receiving tokens from Kinetix, a new perpetual DEX on the KAVA blockchain; they promise a token in January, and similar ones are expected in the future.

Revenue from MVX is in MATIC, from gMVD in ETH.

If you're worried that MVD will fall due to inflation, this shouldn't happen, as the price of MVD is tied to the treasury value.

If MVD trades below its treasury value, then the project buys back and burns MVD tokens.

If MVD is above its treasury value (which can happen due to increased demand for the token and, consequently, the issuance of new MVD tokens), then the DAO prints new MVD tokens and sells them for stablecoins at a discount through a bonding mechanism. This way, the buyer can sell the purchased discounted tokens (which lowers the token's price back to its treasury value), and the project gets stablecoins, which it invests in development or in increasing yield for stakers.

So, with an increase in the number of MVD tokens, its value should not decrease, as new money flows into the treasury.

By the way, you can see how this works in practice right now: On November 25, someone sold a lot of MVD tokens, which crashed the price from $5 to $3.73. I actually bought a bit more during this, and as we can see, the token fairly quickly returned to $5. So such dips are a good opportunity to buy the token at a discount.

DeFi Survivor's Bookshelf

The Optimist: (L)Earn with Defi #22-2 by

Top 5 Beginner Mistakes and How to Fix Them by @WinterSoldierxz

Three Pillars of Booming Crypto Ecosystems by

Polygon Gave DraftKings Multimillion-Dollar Edge in Special Staking Relationship

BAMM; The Revolutionary Primitive Decentralizing The DeFi Trinity

DeFi Projects Radar

Monthly reports

Pyth - November 2023 Report

Silo - November 2023 Report

Magpie - November 2023 Report

Metavault - November 2023 Report

Penpie - November 2023 Report

Radpie - November 2023 Report

Li.Fi - November 2023 Report

Premia - November 2023 Report

Binance Research - Monthly Market Insights - December 2023

Updates

Prisma - Digest #5

Algebra - Weekly Digest #105

Yearn - V3 live on Polygon

Avocado Wallet - Introducing Avocado Protect

LandX - Deep Dive into LNDX Tokenomics

Alpaca Finance - Announcing Immortal Wars: Alpies Game

Plutus - Introducing: plsRDNT V2

Metavault - Bi-weekly recap

Curve - What'up on Curve ? #160

Alpha Whispers

Mozaic

In the project, there's always something happening and I like this kind of activity. They don't publish much information on X, mainly everything is on Discord.

From the interesting stuff:

Theseus vault Development is completed, and the vault is undergoing fine-tuning before a round of closed beta testing.

The xMOZ page has been revised to make the penalties for early xMOZ withdrawals clearer.

xMOZ holders will be able to earn protocol rewards through a new staking feature.

The “Earn” page will be tested on the Arbitrum Goerli testnet soon, and will undergo an audit by Trust Security.

They are revising the initial 2% of supply allocated to incentives for the Hercules vault. Due to recent price action, this figure will need to be lowered to better manage token emissions.

The Hoplites collection will be launched via a Gradual Dutch Auction.

The Hoplites will launch in 3 collections of 375 NFTs. The first collection will be launching next month.

I think the token price will continue to rise sharply in spurts following their various announcements.

In general, the project is actively developing and they regularly hold quite productive AMAs.

Velvet Capital V2

I've been following the Velvet project for over a year now. This project is backed by Binance. Their idea was quite simple - to create ETF-like baskets of various cryptocurrencies.

Previously, they had several strategies available for selection and promised in V2 to allow everyone to create such strategies, while also having the tokens work in third-party DeFi projects. All they did for a whole year was write on Twitter and promise a lot of cool stuff, and of course, they were selling NFTs with a bunch of promised utilities.

Such projects concern me. I don't like it when there are only promises and they also conduct various sales. But it seems that they finally released their V2 and slightly improved their service. For now, they simply made it possible to create baskets of tokens on the BNB chain, which obviously greatly limits your choice of tokens. In general, they did something like the Valio project.

I'm currently testing it and have created a portfolio of strong tokens with deflationary tokenomics and buybacks, and someone has already invested in it. If you want - join my Buyback and Burns strategy

Symbiosis

In the last issue, I reported that the project received a grant from AAVE, and now also from GMX.

It's important to understand that such projects don't just give money to anyone, and receiving two grants from such giants indicates that the project is greatly undervalued and that serious investors believe in its development.

I still consider the bridge from Symbiosis to be the most versatile and convenient. Yes, their tokenomics are not very interesting and there's little utility for their SIS token, but I think changes in this direction will come in the future. For now, it's possible to gradually accumulate the token during dips.

I'd be glad to hear any advice on what to add or change in the comments here or on my X (Twitter).

Previous episode