DeFi Enclave's Chronicles #15

Starknet Airdrop, Campie, Perpetuals, Portfolio Monthly Report, Merkle Trade and much more.

In this episode:

Voyager's Observations - personal reflections and insights on DeFi and Beyond

Voyager's Vault - Detailed Report on My Investment Moves

DeFi Survivor's Bookshelf - Handpicked must-read threads and articles

DeFi Projects Radar - detailed survey of projects news and developments

Alpha/Airdrops Whispers - unexplored DeFi territory, proceed at your own risk

My newsletter is completely free, but there are my referral links to the projects I recommend. I would be grateful if you use them as a small token of appreciation for my work.

🔎 Voyager's Observations

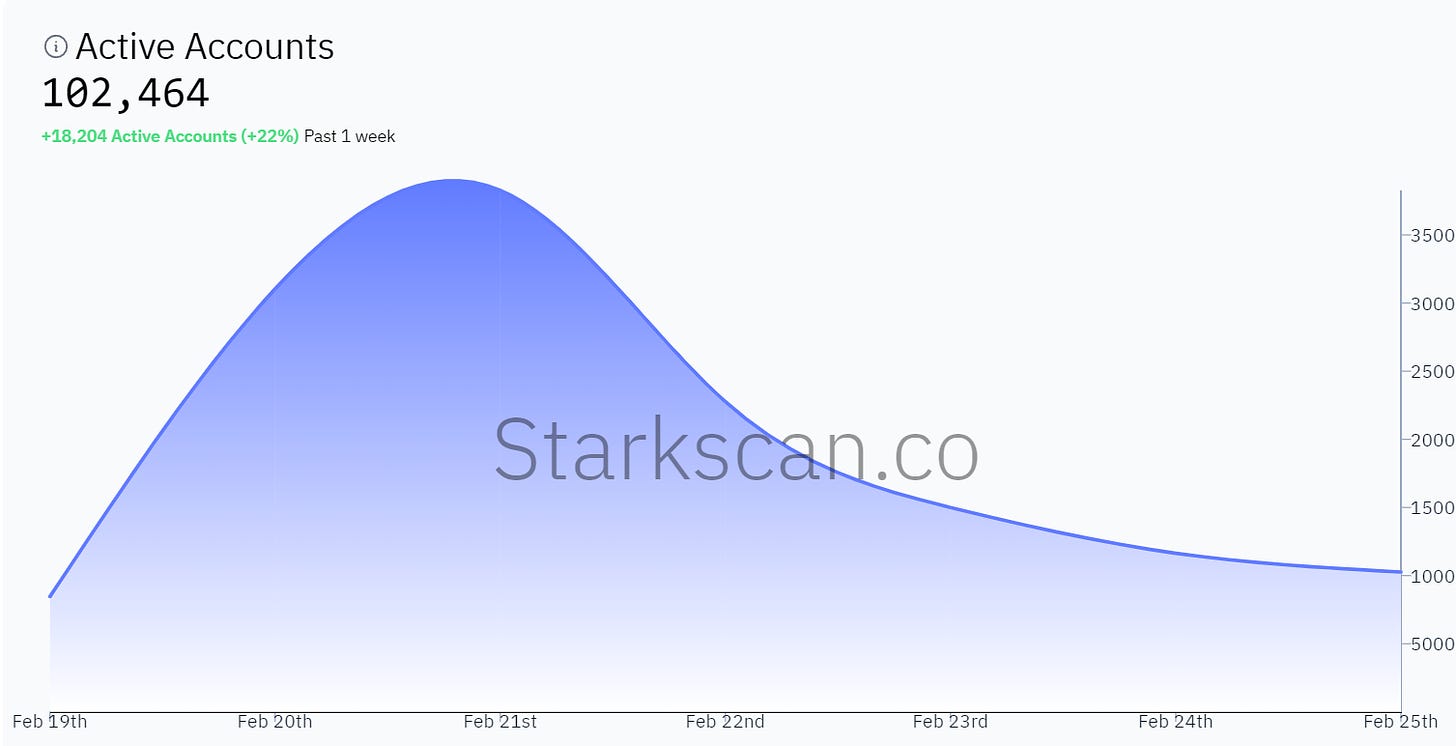

StarkNet Airdrop

Oh Starknet, what have you done. Clearly, you can't please everyone, but you had so many chances not to screw up.

I got 3600 tokens and missed out on the max 10000 tokens by just a month of chain activities. Initially, I was hit by FOMO, but then I saw how many people got cut off because they didn't have the required amount of ETH in their balance on snapshot day. That's when I realized getting the airdrop was just pure luck. I'm not into keeping idle cash in wallets; I aim to have all my funds working for profit or earning points for potential airdrops. Likely, the ETH in my wallet was just because I was over Starknet and didn't engage much, ignoring these tokens due to the network's high fees and sluggishness.

Yep, I've got just one Starknet wallet. Not a big fan of sybils, but am I happy they got shafted ? Not really, because many others who didn't deserve it got shafted too, and they could've easily been me, given my active participation in Starknet. This was not a Sybil attack filter, it was some kind of chaotic shooting.

Things have changed a lot since the Arbitrum airdrop. Now, there are loads of projects creating products for reputation assessment. Starknet even partnered with Nomis not long ago, which does a decent job at evaluating wallet activity, yet no project has tapped into such solutions yet. You've got Nomis, Gitcoin Passport, Galxe ID, and plenty of similar projects that would hand over their database for free just for some project shoutouts.

But Starknet chose to pull something weird and illogical and, as a nod to their mess-up, launched Starknet DeFi Spring, basically a cover-up for the botched launch and a slap in the face from one of the top dogs who called us e-beggars. I sold my tokens at 2.77$ without a second thought and have zero plans to engage with this chain anymore.

So, the current situation with the project's popularity seems like a logical outcome of the team's attitude towards their community.

Campie Launch

Finally, Campie has launched, but I've decided not to participate.

Firstly, I already have a lot of GRAIL, so my risk management doesn't allow me to buy more, and all of it is in the dividends plugin. Naturally, I'm not planning to withdraw them through a six-month vesting period. I think it's a big miss that you can't transfer xGRAIL, or can you ? I've heard about some waitlist on Camelot, where you can add a specific contract, and the token will be able to interact with the code of this contract. Not sure if that's true.

Secondly, I didn't quite understand how Campie is technically going to work. This is a strange hallmark of the Magpie team - launching an IDO for a new project and providing minimal technical information about how it will operate. From what I understand, Campie will work like Cakepie, i.e., Campie will simply boost certain farming pairs as can currently be done through locking GRAIL in the corresponding plugin on Camelot. Personally, this option doesn't interest me.

I like receiving dividends and accumulating xGRAIL as is currently happening in the Dividends plugin.

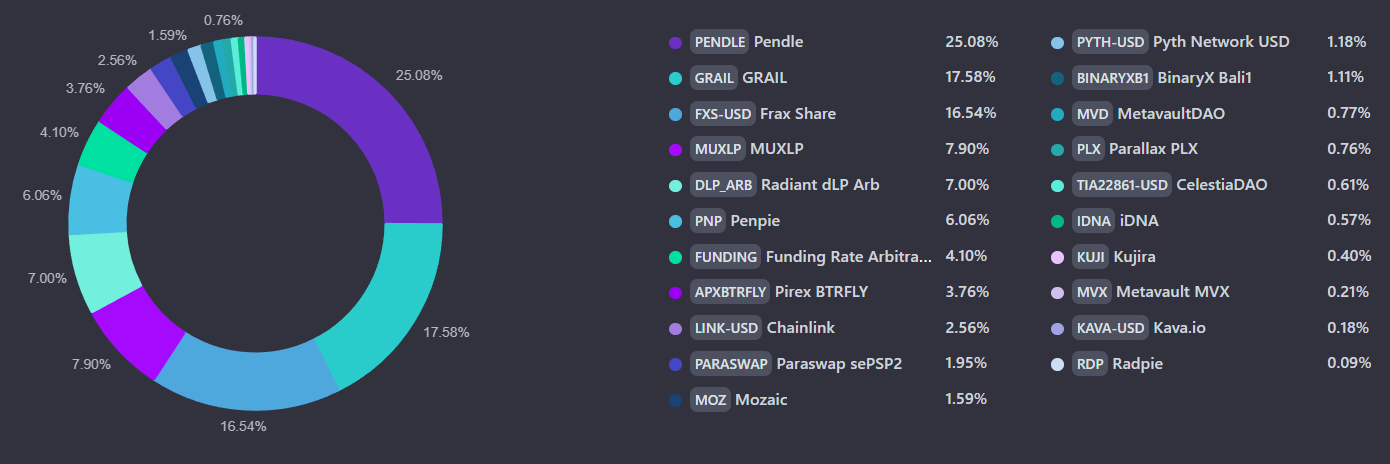

💰 Voyager's Vault

February 2024

Portfolio Objective: Boost the portfolio's value long-term and generate a steady income.

Portfolio Snapshot as of February 29 2024

New positions

PYTH

The entire position in PYTH was farmed as rewards during trading on HMX. I didn't buy anything myself, turned out to be a nice bonus.

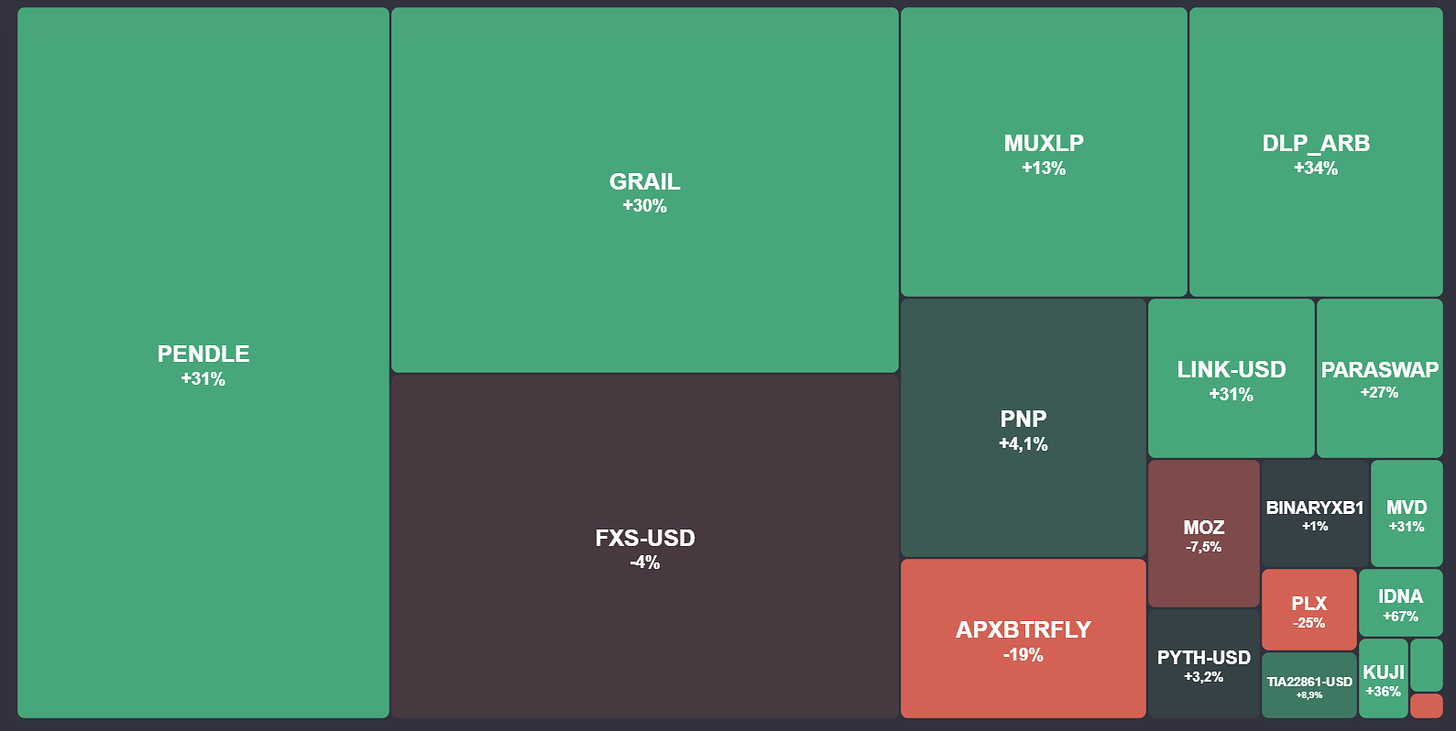

Heat Map for February

In February, passive income from farming/staking accounted for 1.63% of the total capital, which is approximately equivalent to an annual dividend income of 19.60%.

Total portfolio growth in February is +14%.

Not the best month, lol.

My thoughts on the positions

Not much has been happening in my investment portfolio. Currently, I am focused on perpetual DEXes and my Funding rate arbitrage portfolio, about which I recently published an epic article based on my experience.

The crypto industry is growing every day, and I am becoming convinced that it's more efficient to choose one or two sectors to focus on, because covering everything is impossible, or you'll end up like most crypto influencers, who are "experts" in everything that's popular today and pays.

I'm gradually buying PSP & SIS, which is quite a cool combo if you're an active DeFi user.

By investing a bit in these coins, you get a gas refund + revenue share from Paraswap each month, and now Symbiosis also offers significant discounts for cross-chain transfers, you just need to lock up some tokens.

The income from the Starknet airdrop was directed to my perpetual DEX portfolio, and a part was allocated to other interesting airdrops mentioned below. So, I haven't been adding to my main investment portfolio for a long time; it's quite self-sufficient and pleasing with its growth.

I think I will continue not to increase the main investment portfolio but to come up with other thematic portfolios focused on a specific sector or set of projects, through which a comprehensive strategy can be formed. It will be more interesting for you to read about such strategies, and I will develop, rather than getting bored watching PENDLE grow and thinking about how genius I am and that there's nothing else to do.

📚 DeFi Survivor's Bookshelf

8 Crypto Narratives Being Shaped by Mantle Network's Vision - link

New DeFi Meta: The Fraxtal Point System Explained - link

Fraxtal: What You Need to Know - link

What does an MEV Blocker do ? - link

The Balancer Report: Adding a Third Layer - link

Solana & Cosmos Restaking: What You Need to Know - link

Ordinals & BTC DeFi: Start Here - link

EigenLayer Revolution - Lineup of Explosive Protocol Launches - link

ShimmerEVM: What You Need to Know - link

Segment Finance: What You Need to Know - link

BNB Chain 2024 Outlook - The “One BNB” Multi-chain Paradigm - link

How to Make Any Ecosystem Sybil-Resistant: Exploring Nomis' Solution - link

The ultimate guide on how to Contango (v2) - link

Reducing the Inefficiencies of Oracle Extractable Value (OEV) with API3 - link

7 New Things We Learned About Fraxtal From Our Interview With Frax Founder Sam Kazemian - link

Thoughts on Sui’s MoveVM - link

The First Ever Omnichain Domain Release for Injective and Solana - link

Current Perps Landscape: What You Need to Know - link

Alchemix - Project Breakdown - link

How Crazy is the Market and What's Next - link

Algebra Integral: The Uniswap V4 Inspired DEX Solutions Provider - link

Self-repaying Loans with Alchemix: What You Need to Know - link

ZKX Explained: Gamified Perp Trading in the AppChain - link

Trestle - Unlocking Scalability and Pioneers DA Modularity Expansion on Celestia - link

The Castle Chronicle: Volume 57 - link

Why Polygon is "ZK Money" with HUGE Airdrop Potential - link

Ronin Chain Airdrops: What You Need to Know - link

IntentX — The Meta Front-End - link

Reimagining Asset Management: Solv’s Decentralized Approach - link

27% APY on a stablecoin - how sustainable is Ethena Labs ? - link

How to catch a few 20x to 100x coins during the next bull run ? - link

Kinto - KYC L2? What You Need to Know - link

Mantle and mETH - link

Liquid Restaking Report: The Ultimate LRT Q1 2024 Market Overview - link

Stacks 2024 Thesis: What You Need to Know - link

Everything you need to know on Frax Finance new Layer 2: Fraxtal - link

Unlocking Hyperliquid: A Deep Dive into its Future and Fair Valuation - link

🛰️ DeFi Projects Radar

Across - Introducing V3 - link

Algebra - Weekly Digest #115 - link

Algebra - The Next Integral-based DEX on Blast - link

Blitz - Unleashing Synchronous DEX Liquidity - link

Camelot - 2023 Metrics - link

Ethena Labs - Ethena & Synthetix - link

Empyreal - Roadmap for Q1/Q2 2024 - link

Frax Finance - This Week in Frax - February 16, 2024 - link

Frax Finance - FraxCheck #63 - link

Gains Network - January 2024 Recap - link

GMX - GMX 2024 - link

Holdstation - 2023 Wrap-up: Integrating Account Abstraction on zkSync - link

Holdstation - Weekly Recap: Week 3, Feb 2024 - link

IntentX - Major Update - link

IntentX - Intent-Based Spot Trading with Orbs Liquidity Hub - link

Injective - The First Ever Omnichain Domain Release - link

LogX - $LOGX Airdrop Update 1 - link

Meteora - Community Call Recap — 14 Feb 2024 - link

Orderly Network - What’s on Order at Orderly: Our 2024 Roadmap - link

ParaSwap - V6 And The Dawn Of Decentralized Intents - link

RabbitHole - Introducing the Boost Guild - link

Radiant - January 2024 Recap - link

StarkNet - Introducing the Starknet Provisions Program - link

Symbiosis - Introducing a Fee Discount System for veSIS Holders - link

TapiocaDAO - Introducing TAP - link

Vertex - Introducing Vertex Edge - link

ZetaChain - January 2024: The Arrival of ZetaChain Mainnet Beta - link

🪂 Alpha/Airdrops Whispers

Contango

I continue to experiment with various strategies in Contango.

This time, I decided to fully replicate Ethena's strategy, and it took me about 3 minutes. Of course, I don't have any AI optimizations and wrapping in the form of stablecoins, but it works even better than Ethena.

They will soon encounter infrastructural risks such as exchange problems or liquidity issues; it's just a matter of time. And it will be quite interesting to watch how they address these issues and how the capricious community reacts, which will start to realize that it's not all just freebies.

At the same time, small investors like me don't suffer from these risks and take all the profit, which is much more than the 27% promised by Ethena, and we keep all that profit for ourselves.

I found an interesting article about various strategies on Contango.

The ultimate guide on how to Contango (v2)

Merkle Trade

I've already written about this perpetual DEX in one of the recent issues, but I'll write again because this exchange is so pleasant and its gamification so engaging that sometimes I catch myself thinking that I come there not to earn but to level up and craft items.

The only problem with this exchange is that it's on Aptos, which isn't exactly in high demand. If this DEX were on Arbitrum, it would be at the top in terms of trading volume.

Yes, you can communicate with the project through an EVM-wallet. In this case, an Aptos wallet on the platform will be created and binded to your wallet, and you can transfer liquidity there through LayerZero. But still, this is Aptos.

Perhaps the exchange owners are aware of this and might unexpectedly pivot to one of the EVM L2s; by then, it will be too late to farm their airdrop. But for now, there's still time to farm future tokens, get some APT rebates and some loot.

https://airdroptracker.notion.site/0180555ffe5249009c4096f97b2fb046?v=4bafb955f76c403f84564d383965104d - It's quite an interesting table for tracking airdrops; I have a similar one. It's surprising when you encounter completely unknown projects in such tables, despite being immersed in crypto 24/7. It's truly impossible to keep up with everything.

https://www.spheron.network/ - A service where you can order pre-configured nodes of various projects if you don't know how to set them up yourself or if you're just too lazy. But, of course, the prices here are not very pleasant.

RouterNitro - a pretty nice, cheap, and fast cross-chain bridge, where for transactions and other activities you get carrots (wtf?), which you use to feed a rabbit and level it up. Naturally, all for the sake of an airdrop.

My newsletter is completely free, but there are my referral links to the projects I recommend. I would be grateful if you use them as a small token of appreciation for my work.

I continue to make a significant bet on participating in the following projects:

Ether.fi - Have Robot NFT(wtf ?) on Ether.fan, some YT-eETH on Pendle for points

Dolomite - Lend/Borrow/Galxe OATs

Drift Trade - points/tickets

Hyperliquid - points

Nostra - Lend/Borrow

Izumi (Mantle + ZkSync + Scroll) - LP/Swaps - The project promises to share all airdrops it receives, with the nearest being for Mantle Journey(still waiting). Other relevant ones include ZkSync, Scroll, and other chains.

Gravita - The rewards for the project look promising.

Cega - Cool project for options traders.

Velvet Capital - I have been participating in the project for a while now and even successfully managing an investment portfolio there. Feel free to join.

IntentX - Making a big bet on this project, I continue to accumulate points.

Swell - I have high hopes for Swell, even though I also passed it by for quite a while, along with EigenLayer. Finally, Swell will soon launch rswETH, and they will enter L2.

Kamino - Lend/Borrow for points

CARV Gaming - exp/levels

GRVT - new perp dex, collecting boxes

Ithaca - testnet/points

Merkle Trade - getting levels

KiloEx - points + NFTs. Trying to get 100k points to earn VIP badge

Paraswap - staking PSP for fee refund + Paraswap revenue share

HMX - all-in for their token

Vertex - going to accumulate VRTX, they have crazy roadmap

LogX - new promising perp DEX aggregator with a lot of incentives

My Nodes

Nulink

Avail

Lumoz

Idena

I'd be glad to hear any advice on what to add or change in the comments here or on my X (Twitter).