DeFi Enclave's Chronicles #12

Eigenpie, Points, HMX, Vertex, Paymaster wars, Perp DEX with elements of RPG and much more.

In this episode:

Voyager's Observations - personal reflections and insights on DeFi and Beyond

Voyager's Vault - Detailed Report on My Investment Moves

DeFi Survivor's Bookshelf - Handpicked must-read threads and articles

DeFi Projects Radar - detailed survey of projects news and developments

Alpha/Airdrops Whispers - unexplored DeFi territory, proceed at your own risk

My newsletter is completely free, but there are my referral links to the projects I recommend. I would be grateful if you use them as a small token of appreciation for my work.

Voyager's Observations

Points, points, points…

I love points. I believe it's a completely logical and correct development for the industry.

The main advantage of points for us - ordinary users who want to earn through our efforts - is that points have launched a serious competitive contest between projects.

Previously, everything was based on promises and how much money you raised from investors, and a project could essentially tell you to get lost when asked about airdrops. But now, the project is obliged to eventually pay its users. I suppose that gradually farming points will turn into a stable income. The project will pay rewards on a regular basis to its users based on the points they have accumulated. Projects like Marginfi will be dismissed if they stretch their point farms over years. Users will migrate to where payments are guaranteed and regular.

Accumulate a certain number of points in a week - receive a payout. It's quite possible that soon there will be a real profession of earning on DeFi, and income will depend solely on our efforts and intelligence. Properly studied pointonomics, fees, tokenomics, and there you are, calculating how much you'll earn if you work well with a project.

Thoughts on Mantle Journey

While crowds of influencers were reprinting each other, telling about secret ways of earning on airdrops, the Mantle Journey campaign was quietly and peacefully underway.

I am increasingly convinced that most people come into crypto for quick profits with just a couple of hundred bucks and no more, simply because they don't have more. They are looking for where to get freebies quickly and, if possible, for free, without doing anything.

At the same time, Mantle rolled out very specific conditions - make a transaction in our network and get 10 miles, at the end of the campaign, receive MNT tokens. In addition to this, we give a bunch of money to various projects, which will also reward you.

No secret algorithms for $1, no empty promises - here are the rules, let's go. And it seems that people are not used to seeing such specifics, they need a dream, a sudden bag of money for little effort, they don't want to work hard for money, they want a sudden pile of cash, they want to believe in the dream of becoming rich.

Eigenpie launch

While everyone was waiting for the launch of Campie, the Magpie team went ahead and launched the Restaking SubDAO Eigenpie.

This shows how much the ecosystem (and this is now a real entire DeFi ecosystem) has learned to adapt to the narratives of the industry and participate in the most significant trends.

I definitely plan to participate in the IDO and use the platform. I even thought about transferring my swETH staked in EigenLayer to the Eigenpie platform.

My only question is - Eigenpie becomes a direct competitor to Penpie, how do they plan to coexist ?

I suppose the ideal option would be to integrate Eigenpie with Penpie by adding the ability to stake LST m-tokens from Eigenpie on Penpie. But Penpie is essentially a layer over Pendle, so first, it would be necessary to add a bunch of new pools on Pendle, will they agree to this ?

Such integration would be amazing in its efficiency as it would create an endless value loop on Pendle for ETH staking.

Voyager's Vault

Once a month at the beginning, I make a snapshot of my portfolio with detailed proportions and P/L.

You can check November Report in DeFi Enclave's Chronicles #9

Today, I will share some updates and thoughts regarding the changes in my portfolio over the past week.

I have set up a separate wallet specifically for working with funding rate arbitrage. It's easier to manage assets, and I also get some benefits from using my own referral link (is this legal btw ?).

I am currently using Vertex + HMX. For many, the obvious choice would be Drift + Hyperliquid in hopes of airdrops, but I chose a clear income that I am already receiving, rather than promises that might not be fulfilled.

Indeed, HMX & Vertex are pretty cool exchanges from a technical standpoint. The guys there really understand the various nuances that should be present in functionality. But HMX's whole bet is on their HMX token, the value of which will be diluted due to inflation. As for Vertex, it's time to think about what will happen to it after their ARB share under STIP runs out. In terms of working on Vertex - it's ideal, but will compensation with just the VRTX token be enough considering there are so many competitors around.

I am currently accumulating micro-positions in MAV, BIFI, PSP, HOLD (read about Holdstation below), SIS, VRTX.

PNP - I will gradually move onto it from PENDLE. In the next issue, there will be a monthly portfolio report, and it looks like income will be at a record level for this month.

DeFi Survivor's Bookshelf

Diving into Metis: The Unique Layer 2 Solution for True Decentralization - link

The Only Safe Way to Store Crypto - link

Akash: What You Need to Know - link

Clever Loans - The Nitty Gritty On How They Work! - link

Native and bridged USDC: differences and uses - link

The Castle Chronicle: Volume 53 - link

Crypto Layers Simplified: Layer 0 vs Layer 1 vs Layer 2 vs Layer 3 - link

Binance Research: Q4 State of Crypto: Market Pulse - link

How to Farm Juicy FXB Yields on Arbitrum - link

The Biggest Airdrop in Solana’s History - A Deep Dive on Jupiter - link

Breaking Down Berachain With Smokey The Bera - link

Seven Key Cross-Chain Bridge Vulnerabilities Explained - link

Cadence Protocol Explained: Intent-Centric Perpetuals Aggregator - link

Why you need to start paying attention to Vertex - link

Akash: What You Need to Know - link

$TIA Staking Pros & Cons - link

Tokenomics 101 - valuable knowledge before the 2024-2025 bullrun - link

What Sets Synonym Apart? - link

Layer 3 DeFi & “Intents”: The Next Frontier For zkLink - link

Pendle's Success: What You Need to Know - link

How To Use Farcaster and Warpcast - link

DeFi Projects Radar

Algebra - Weekly Digest #112 - link

AladdinDAO - Monthly Newsletter - link

AltLayer - Airdrop Season One - link

Balancer - Report: Incentivized alignment - link

CARV - Introducing Data To Earn 2.0: Major Expansion and Bigger Earnings - link

Cow Protocol - CoW DAO’s 2023 in Numbers - link

Contango - Introducing points system - link

Convergence - Launch plan - link

Convergence - Airdrop — On-chain quests - link

Curve - What'up on Curve ? #168 - link

Drift - Introducing Drift Points - link

Eigenpie - Point System and 3M FDV IDO - link

Fuel Labs - Inside Fuel - Q4 2023 - link

Florence Finance - Roadmap - link

Galxe - 2023 Year In Review - link

Holdstation - Accelerating the Growth of zkSync with Holdstation Paymaster - link

Kakarot - Journey Through 2023 - link

Landshare - Development Update — January 22nd, 2024 - link

Magpie - EigenLayer Meets Magpie: Liquid Restaking ETH - link

Matcha - Maverick v1 liquidity on Matcha - link

Meteora - Community Call Recap— 24 Jan 2024 - link

Nostra - Introducing Nostra Pools - link

Orbiter - From Bridge to Rollup, Reshaping the Ethereum Ecosystem - link

Orderly Network - Opts For OP Chain, Launches Optimism Vault - link

Swell - Deep Dive | January 22nd - link

Starknet - Roundup #101 - link

Synapse - World Domination Plan: Step 1 - RFQ Bridging - link

ZetaLabs - Airdrop Pre-Claim - link

ZetaLabs - Token Utility and Update on Rewards - link

Alpha/Airdrops Whispers

ZkSync + Holdstation = Paymaster Wars

It seems that a new trend is emerging - paymaster wars, and the perp DEX Holdstation is a leader here with their token HOLD.

Paymaster is a feature of the ZkSync chain.

To put it briefly, the concept is as follows:

Project X collaborates closely with Holdstation to develop a paymaster system that facilitates gas payments exclusively in HOLD.

Users who choose to settle gas fees with HOLD within Project X receive attractive discounts.

The sponsorship of these gas fee discounts by the Holdstation Grant to Project X serves as a strategic incentive to cultivate and maintain an active user base.

The HOLD acquired by Project X from the paymaster can be staked to earn trading fees from Holdstation.

And this system is already operational on SyncSwap - a top DEX on ZkSync.

In just 20 days after the integration of the Holdstation Paymaster for network fee payments with HOLD, Syncswap has effectively saved its users approximately $38,000, which translates to annual savings of around $700,000. During this period, Syncswap accumulated a total of 8278 HOLD from users using it for fee payments, equivalent to over 12,500 HOLD per month. Syncswap consistently extracts HOLD from the paymaster and strategically stakes it, actively participating in DAO voting.

So, the top DEX gets HOLD tokens for free and stakes them on the Holdstation platform, generating income, users increase the demand for the HOLD token and receive discounts on transaction fees. Does this create a win-win-win situation ?

Now, imagine when other projects join in, competing by increasing discounts on commission payments if you pay with their specific token ?

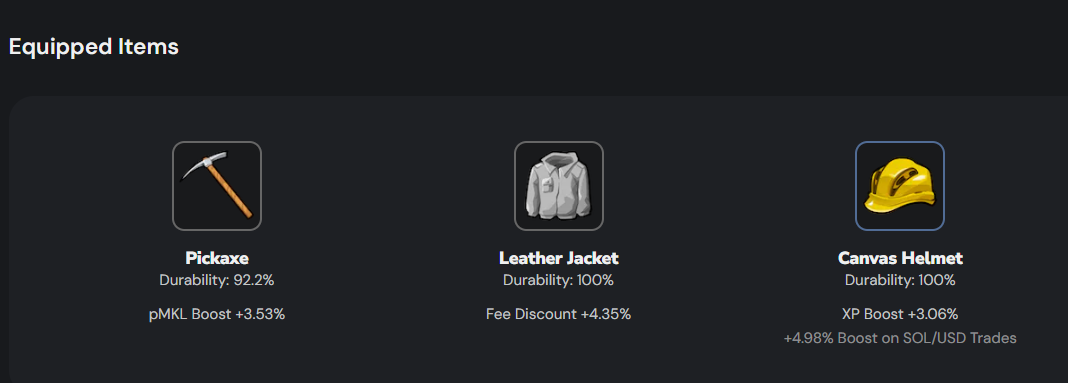

Merkle.trade - Perp DEX with RPG elements

When I stumbled upon the Merkle exchange, my first thought was "How interesting!" and the second was "Why didn't anyone think of this before?"

It's long been proven that adding elements of gamification to any activity significantly increases its effectiveness. This is how our brain works; we get real pleasure from seeing ourselves gain a new skill, level up, or obtain some loot.

So, the Merkle exchange, though still quite small and operating on Aptos, could soon take off precisely because of the gamification elements integrated into trading.

Here, you level up, complete missions, and receive loot that temporarily boosts your income.

In short, I advise keeping an eye on this exchange.

My newsletter is completely free, but there are my referral links to the projects I recommend. I would be grateful if you use them as a small token of appreciation for my work.

I continue to make a significant bet on participating in the following projects:

Ether.fi - Have Robot NFT(wtf ?) on Ether.fan, some YT-eETH on Pendle for points

Dolomite - Lend/Borrow/Galxe OATs

Drift Trade - points/tickets

Hyperliquid - points

Nostra - Lend/Borrow

Izumi (Mantle + ZkSync + Scroll) - LP/Swaps - The project promises to share all airdrops it receives, with the nearest being for Mantle Journey. Other relevant ones include ZkSync, Scroll, and other chains.

Gravita - The rewards for the project look promising.

Cega - Cool project for options traders.

Velvet Capital - I have been participating in the project for a while now and even successfully managing an investment portfolio there. Feel free to join.

IntentX - Making a big bet on this project, I continue to accumulate points.

Swell - I have high hopes for Swell, even though I also passed it by for quite a while, along with EigenLayer. Finally, Swell will soon launch rswETH, and they will enter L2.

Kamino - Lend/Borrow for points

CARV Gaming - exp/levels

GRVT - Boxes

Ithaca - testnet/points

Merkle Trade - getting levels

KiloEx - points + NFTs. Trying to get 100k points to earn VIP badge

Paraswap - staking PSP for fee refund + Paraswap revenue share

HMX - all-in for their token

Vertex - going to accumulate VRTX, they have crazy roadmap

LogX - new promising perp DEX aggregator with a lot of incentives

Chromatic Finance - new perp DEX, mainnet launch soon

My Nodes

Nulink

Avail

Starknet

Lumoz

Idena

I'd be glad to hear any advice on what to add or change in the comments here or on my X (Twitter).

Previous episode

DeFi Enclave's Chronicles #11

In this episode: Voyager's Observations - personal reflections and insights on DeFi and Beyond Voyager's Vault - Detailed Report on My Investment Moves DeFi Survivor's Bookshelf - Handpicked must-read threads and articles DeFi Projects Radar - detailed survey of projects news and developments

Great as usual. Thanks !