Deep Dive into Algebra Finance (ALGB)

What is Algebra ?

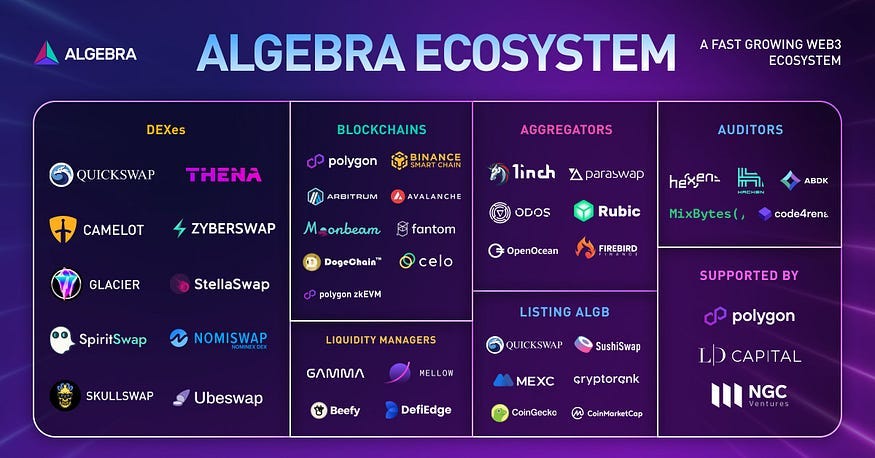

Algebra is a next-generation decentralized exchange (DEX) built on the Polygon network.

It operates on the Automated Market Maker (AMM) model and supports Concentrated Liquidity.

Algebra is the first DEX to introduce Concentrated Liquidity with Farming and Dynamic fees, which help in reducing Impermanent Loss.

Users can swap cryptocurrencies, provide liquidity, stake the native ALGB coins, and participate in farming to earn extra incentives.

The platform caters to various participants, including Liquidity Providers, Regular traders, and Arbitrageurs.

Algebra's Solution to DEX Problems:

Liquidity Fragmentation: With many DEXs in the market, liquidity (the amount of assets available for trading) gets spread out. This means traders might not always get the best deals, and liquidity providers might not earn as much as they could. Algebra's solution consolidates all this liquidity into one place, making trading more efficient.

Customizable Liquidity Pools: Algebra V2 allows DEXs to create their own tailored liquidity pools. This means DEXs can offer unique features while still benefiting from the larger pool of assets Algebra provides.

Dynamic Fees: Instead of fixed fees like some other platforms, Algebra allows DEXs to adjust fees based on market conditions. This can lead to better profits for liquidity providers and more competitive rates for traders.

Algebra Liquidity Layer: This is a new foundational layer Algebra is developing. It will combine various DEX protocols into one system. This layer will gather all the liquidity in one spot, making trades more efficient. DEXs can still operate independently but will benefit from the shared pool of assets.

Efficient Swaps for Traders: With all the liquidity in one place, traders can easily find the best trading paths, leading to better deals.

Enhanced Features: Algebra's system will also offer features like easy migration between DEXs and simpler liquidity management.

Tokenomics

Algebra Token ($ALGB) Details:

Type: ERC-20 token on the Polygon network.

Contract Address: 0x0169eC1f8f639B32Eec6D923e24C2A2ff45B9DD6

Name: Algebra

Ticker: ALGB

Total Supply: 750,000,000 ALGB

Circulation Supply: 331,000,000 ALGB

Decimals: 18

Listing: The token is listed on QuickSwap.

Current Token Distribution:

Ecosystem Growth: 196,000,000 ALGB (1-year cliff, 24-month vesting)

Treasury Fund & Marketing: 161,000,000 ALGB (24 months vesting)

Team: 50,000,000 ALGB (25% Unlocked immediately, with the rest unlocked in stages over 24 months)

Advisory: 12,000,000 ALGB

Staking (ending in October 2023): 124,806,000 ALGB (Locked)

On Market: 206,194,000 ALGB (Unlocked)

Total: 750,000,000 ALGB

Token Utility:

Governance: Token holders can submit proposals and vote on various matters. To submit a proposal, one needs 1% of the supply.

Yield Farming: In partnership with other entities.

Treasury Fund Usage: For marketing campaigns, grants, and listing fees.

Deflationary tokenomics:

Algebra's tokenomics is deflationary.

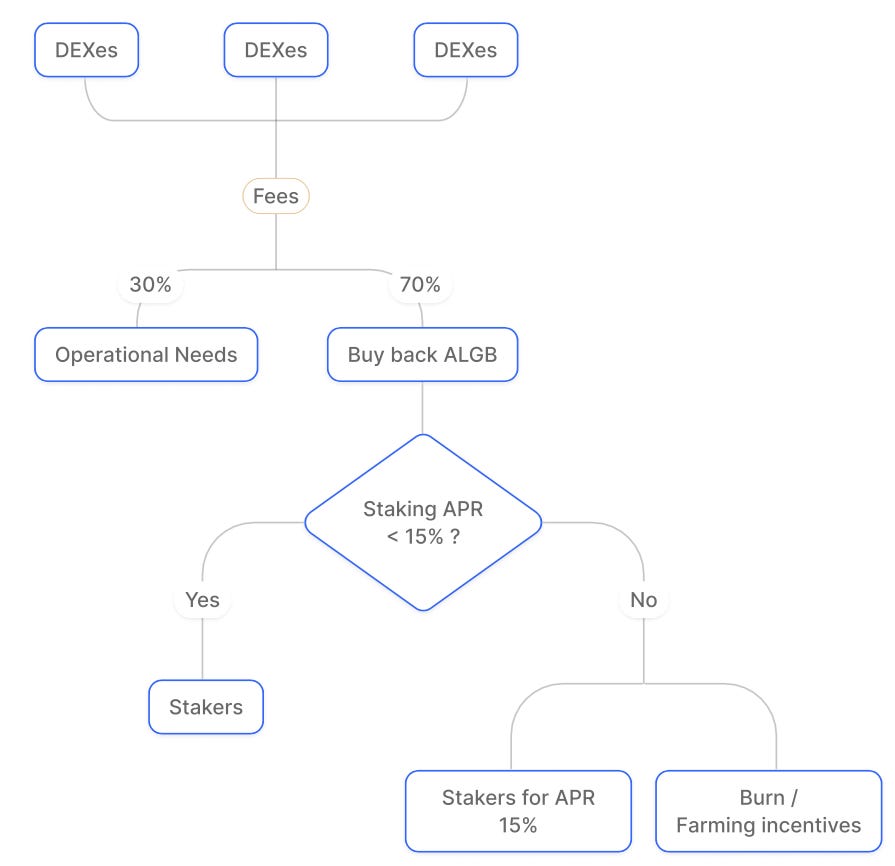

The protocol collects fees from every integrated DEX powered by Algebra. The fee amount varies based on the DEX's tokenomics and depends on the trading volume. Fees are collected weekly.

30% of the collected fees are used for operational needs.

70% is used to buy back $ALGB on the QuickSwap DEX.

The bought $ALGB tokens are distributed to stakers to achieve a 15% APR.

Any extra $ALGB (beyond the 15% APR) can be burnt or used as farming rewards.

Audits

Algebra was audited by Hacken on December 15th, 2021.

Executive Summary:

The smart contracts of Algebra Finance were found to be well-secured.

The analysis included code functionality checks, manual audit, and automated checks with tools like Mythril and Slither.

Initially, 1 medium and 2 low severity issues were found.

After the second review, the medium issue was resolved, leaving 2 low severity issues.

After the third review, all issues were addressed.

Audit Conclusion:

The smart contracts within the scope were manually reviewed and analyzed with static analysis tools.

As a result of the audit, all identified issues (1 medium and 2 low severity) were addressed by the end of the third review.

Algebra vs Uniswap V3

Customizable Tickpacing:

Algebra allows DEXs to adjust tickspacing, which is especially beneficial for stablecoin pairs. This feature provides more flexibility and efficiency compared to the fixed model of Uniswap V3.

Dynamic Fee Model:

Uniswap has fixed fees for its pools, which can limit liquidity providers' profitability.

Algebra offers a dynamic fee model, calculating fees based on various factors like volatility, risk, trading, and pool volume. This ensures better conditions for liquidity providers, optimizing their profits.

Concentrated Liquidity:

Algebra's concentrated liquidity technology lets users set specific price intervals for their assets, leading to higher capital efficiency and deeper liquidity. This contrasts with Uniswap V3's broader approach and offers more control to liquidity providers.

Built-in Farming:

Unlike Uniswap, which lacks on-platform farming, Algebra introduces built-in farming. This allows users to provide liquidity and earn rewards directly, eliminating the need for external platforms.

Rebase Tokens Support:

Algebra's second version supports rebase tokens (elastic supply tokens), a feature not present in other concentrated liquidity platforms, including Uniswap V3. This offers more versatility and support for a broader range of tokens.

Enhanced Limit Orders:

Algebra introduces on-chain Limit Orders based on ticks for Concentrated Liquidity (CL), allowing traders to set predefined prices for order execution. This feature enhances the trading experience and provides more opportunities for market makers and traders.

Community-Centric Approach:

Algebra aims to reward its community by allowing holders to stake their ALGB tokens and receive a portion of the development fees and commissions. This community-focused approach contrasts with Uniswap's model.

In summary, Algebra offers a range of features and innovations that position it as a more flexible, efficient, and community-centric solution compared to Uniswap V3.

Algebra Integral: A New Approach to DEX

Algebra 'Integral': The latest version of Algebra, named 'Integral', acts as a powerful engine for DEXs, striking an optimal balance between gas costs and functionality. It introduces enhanced flexibility for both partners and users, allowing DEXs to seamlessly integrate and update plugins without the hassle of migrating liquidity. This adaptive architecture is tailored to meet the ever-changing demands and trends of the DeFi ecosystem.

Modular Structure: Algebra's modular structure allows for the disabling, switching on, or upgrading of individual plugins without wasting gas. This ensures efficiency and reduces disruptions for users.

One Pool for Each Pair: Algebra maintains a single pool for each token pair, minimizing liquidity fragmentation. This approach simplifies liquidity allocation and optimizes swap routes.

The Plugin System: The Algebra architecture can be visualized as a pool with exchangeable modules or plugins. These plugins can extend or modify the standard behavior of liquidity pools. The protocol can replace plugins for pools at any time, allowing for continuous development.

Standard Plugin: Algebra provides a standard plugin that offers functionalities like TWAP-oracle, Volatility-oracle, Dynamic fee, and On-chain farmings.

Algebra Protocol 'Integral' introduces a modular architecture that addresses challenges faced by existing DEXs. Its flexibility, security, and efficiency are designed to meet the evolving needs of the DeFi ecosystem.

Investment conclusion:

While Algebra offers innovative solutions, it's still relatively new in the DeFi space. As with any emerging platform, there's inherent risk associated with how it will adapt and evolve.

The DeFi space is highly competitive, with platforms like Uniswap having a significant market presence. Algebra needs to continuously innovate to stay ahead.

From an investment perspective, Algebra presents a promising opportunity. Its innovative approach to solving core DEX problems, combined with its adaptive architecture, positions it well in the rapidly evolving DeFi landscape. However, potential investors should be aware of the risks associated with emerging platforms and the highly competitive nature of the DeFi space. As always, thorough due diligence is recommended before making any investment decisions.